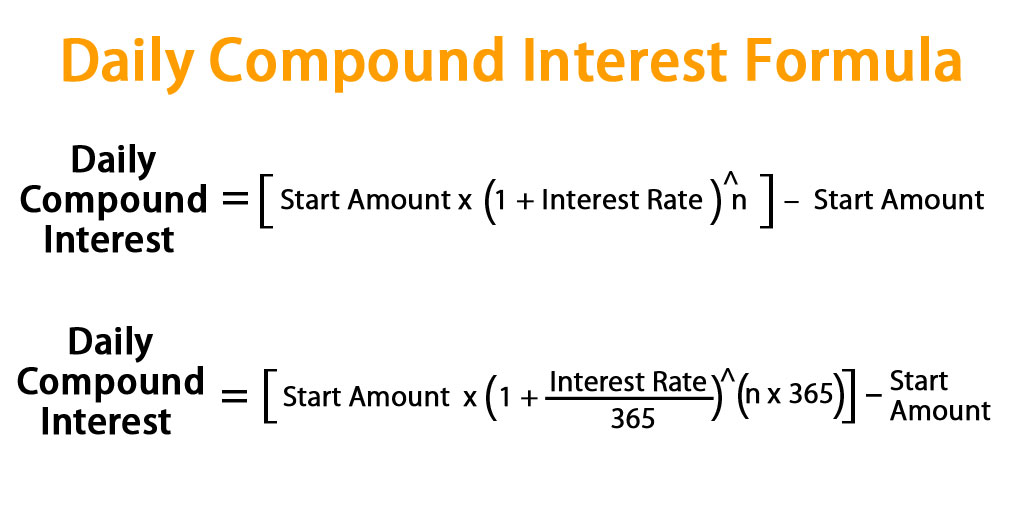

Compounding interest requires more than one period so let s go back to the example of derek borrowing 100 from the bank for two years at a 10 interest rate.

1 year cd interest rate calculator.

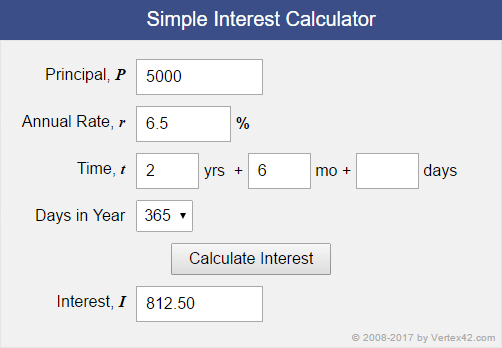

5 000 in a one year cd.

Cd rates could change significantly in a year and you might not want to miss out on a.

If you re looking to meet a particular savings goal a cd calculator lets you quickly change period lengths deposit amounts and apy rates to find the right option.

How much interest you earn on your 360 cd account will depend on how much you deposit your specific term and interest rate.

Consider interest rate trends to decide on the ideal term for your cd.

Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators publishing original and objective.

Check out current capital one 360 cd rates and terms to see how much you can earn.

A 5 year cd while a 5 year cd might have a higher apy a shorter term cd can be a better option.

In late 2007 just before the economy spiraled downward they were at 4.

For instance a cd laddering plan of three cds might have a one year cd a two year cd and a three year cd.

Choosing the right type of cd.

Cd rates have declined since 1984 a time when they once exceeded 10 apy.

If interest rates are climbing choose a shorter term cd so you aren t locked in to a lower rate.

A cd s apy depends on the frequency of compounding and the interest rate.

Since apy measures your actual interest earned per year you can use it to compare cd s of different interest rates and.

100 10 10.

Cd calculators allow you to quickly determine how much you re going to make with a particular cd option.

3 year cd rates.

In comparison the average one year cd yield is around 0 4 in 2017.

If you have 15 000 to invest you could invest 5 000 in each rung.

For example a 10 000 deposit in a five year cd with 1 50 apy will earn about 773 in interest while a cd with 0 01 apy all other factors the same only earns 5 in interest.

Want to see.

You can use a cd rate calculator to see how much you will earn at the end of your term.

If interest rates are falling choose a long term cd so you lock in the higher rate for the cd s term.